Recently, an announcement made by microstrategy

microstrategy Business Intelligence executive chairman michael saylor

microstrategy Business Intelligence executive chairman michael saylor

michael saylor Micheal J Saylor is the greatest visionary in the Information Systems industry. An enthusiastic blockchain influencer and a splendid leader. He believes that prudent institutional investors should only consider trusting a crypto-asset network after it has operated reliably for at least ten years without a hard fork.

michael saylor Micheal J Saylor is the greatest visionary in the Information Systems industry. An enthusiastic blockchain influencer and a splendid leader. He believes that prudent institutional investors should only consider trusting a crypto-asset network after it has operated reliably for at least ten years without a hard fork.

He is an American entrepreneur and business executive, who co-founded Microstrategy, a company that provides business intelligence, mobile software, and cloud-based services, under his leadership Microstrategy has grown at a tremendous rate and made a mark in the BI industry, and he is chairman and CEO of the same Microstrategy. He is a vocal advocate of bitcoin. He is highly skilled in enterprise software, and also has a rich knowledge of numerous fields including analytics, data warehouse, leadership, SaaS, management, cloud computing, startups, professional services, enterprise architecture, mobile devices, and many more.

In 1983, he matriculated at the Massachusetts Institute of Technology (MIT) on an air force ROTC scholarship. And then, he joined the Theta delta chi fraternity, through which he met the future co-founder of Microstrategy, Sanju K Bansal. He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society. He is volunteering at Saylor Academy as a Trustee, which provides free college education to all students worldwide.

The way he expertizes himself in Bitcoin, people started calling him the Bitcoin bull, he is the most optimistic person when it comes to Bitcoin. He expects the entrepreneur to keep buying Bitcoin every time it dips. The bitcoin community has begun to rise to the fact that his company might own too much bitcoin. Owning too large a portion of bitcoin could be harmful to the cryptocurrency’s decentralized culture that Bitcoin has so rigorously built over the years. He is still expected to be a principal BTC champion throughout the year. Instructing businesses about Bitcoin potentially through his powerful podcasts and learning courses. (email protected) EntrepreneurCrypto and Blockchain ExpertAuthor about his $1 billion worth of Bitcoin personal investment created headlines. This move has reignited discussions around Bitcoin holdings, particularly those of public companies. MicroStrategy’s obsession with Bitcoin is well-known, having steadily increased its holdings since 2019.

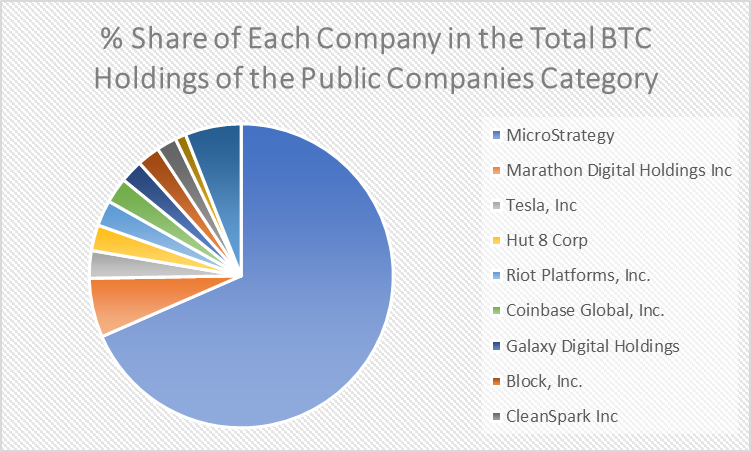

In this article, we will explore all the major data sets compatible to explain the current Bitcoin Holding scenario in the world. This will primarily focus on the top public companies by bitcoin holdings. Naturally, MicroStrategy is going to be the central point of this, as it is a company that holds nearly 68.45% of the total bitcoins held by the public companies category. This is expected to be a memorable journey. Please join!

Bitcoin Holdings by Category: Who Holds What?

Let’s start by breaking down the Bitcoin holdings by different categories. Of the 21 million Bitcoins, the maximum supply cap, approximately 2,609,343 BTC is held by ETFs, countries, public companies, private companies, BTC mining companies, and DeFi platforms.

| Category | Bitcoin Holding | Bitcoin Holding (%) |

| ETFs | 1,057,839BTC | 5.037% |

| Countries | 539,182BTC | 2.568% |

| Public Companies | 330,862BTC | 1.576% |

| Private Companies | 525,474BTC | 2.502% |

| BTC Mining Companies | 53,848BTC | 0.256% |

| DeFis | 155,986BTC | 0.743% |

The category of ETFs holds over 1,057,839BTC, which is nearly 5.037% of the maximum supply cap of BTC. Thus, this category tops the list in terms of Bitcoin Holdings by Category. The category of countries follows with 2.58% (539,182BTC), and the category of private companies sits in the third position in the list above the category of private companies, with 2.502% (525,474BTC. The category of public companies only holds 330,862BTC, which is just 1.576%. DeFis and BTC Mining Companies show as low as 0.743% and 0.256% Bitcoin Holdings, respectively.

By now, we have learned that the category of public companies do hold a considerable amount of BTC, though not as much as the top three categories like ETFs, countries and private companies.

Top Public Companies by Bitcoin Holdings

Here is the interesting part. Nearly 68.45% of the total bitcoins held by the category of public companies is held by MicroStrategy, which is at least 226,500BTC out of 330,862BTC. This is why we need to analyse MicoStrategy separately.

| Company | Bitcoin Holding | Bitcoin Holding (%) |

| MicroStrategy | 226,500BTC | 1.079% |

| Marathon Digital Holdings Inc | 20,818BTC | 0.099% |

| Tesla, Inc | 9,720BTC | 0.046% |

| Hut 8 Corp | 9,109BTC | 0.043% |

| Riot Platforms, Inc. | 9,084BTC | 0.043% |

| Coinbase Global, Inc. | 9,000BTC | 0.043% |

| Galaxy Digital Holdings | 8,100BTC | 0.039% |

| Block, Inc. | 8,027BTC | 0.038% |

| CleanSpark Inc | 7,082BTC | 0.034% |

| Bitcoin Group | 3,830BTC | 0.018% |

When the category of public companies holds around 1.576% of the total BTC supply cap, Microstrategy alone holds at least 1.079%. The second top in the list of the top public companies by bitcoin holdings, Marathon Digital Holdings Inc. only has 20,818BTC (0.099%). Tesla Inc, Hut 8 Corp and Riot Platforms Inc are the other top companies on the list. Tesla Inc and Hust 8 Corp show 9,720BTC and 9,109BTC respectively, and Riot Platforms Inc display 9,084BTC. Coinbase Global Inc and Galaxy Digital Holdings are also on the list with 0.043% and 0.039% Bitcoin Holdings percentages respectively. The BTC Holdings percentages of other major players like Block Inc., CleanSpark Inc. and Bitcoin Group range between 0.038% and 0.018%.

| Company | % of 330,862BTC (held by The Public Companies category) |

| MicroStrategy | 68.45% |

| Marathon Digital Holdings Inc | 6.29% |

| Tesla, Inc | 2.93% |

| Hut 8 Corp | 2.75% |

| Riot Platforms, Inc. | 2.74% |

| Coinbase Global, Inc. | 2.72% |

| Galaxy Digital Holdings | 2.44% |

| Block, Inc. | 2.42% |

| CleanSpark Inc | 2.14% |

| Bitcoin Group | 1.15% |

| Others | 5.97% |

As said earlier, MicroStrategy clearly dominates the category of public companies with 68.45%, that is this public company holds nearly 226,500BTC out of 330,862BTC (which is what the entire category holds). Marathon Digital Holdings Inc, though is the second topmost in the list, only has a 6.29% share in the category of total BTC holdings. Even poorer is the share of Tesla INC and the others. None of the others in the top ten list cross the mark of 3%. Tesla Inc. and Hunt 8 Corp show 2.93% and 2.75% respectively.

The Rise of MicroStrategy’s Bitcoin Holdings

Are you wondering how MicroStrategy has become such a big player in the public companies category in terms of bitcoin holdings? Let’s understand the path through which it has reached such a staggering peak of 226,500. On March 5th, 2021, the Bitcoin holdings of MicroStrategy were just 91,064BTC. In June the same year, it crossed the mark of 100,000BTC. On June 21st, 2021, it was nearly 105,085 BC. By the end of that year, it reached 124,051 BC. In 2022, the growth was slow. On December 24, 2022, it was just around 132,500 BTC.

The year 2023 was different and positive in every way for MicroStrategy’s Bitcoin Holdings. The number of BTC holdings grew from nearly 138,955BTC (on March 23, 2023) to 189,150BTC (on December 27, 2023). In 2024, it crossed another milestone, when it surpassed the mark of 200,000BTC in March. On March 11, 2024, it touched 205,000BTC. From that point, the growth was steady. On June 20, 2024, it recorded 226,331BTC. Now it stands at a peak of 226,500BTC. At present, we see nothing to assume that this range is likely to decrease any time in the near future. There are many who expect the crossing of the 300,000BTC mark by MicoStrategy. Is it possible?

The question can be answered better if we can go through MicroStrategy’s BTC purchase history. Did MicoStrategy make any significant BTC purchases in the recent past?

MicroStrategy Bitcoin Purchase History

Let’s do an analysis of MicroStrategy’s purchase history, and understand what it conveys about the company’s holding strategy.

| Date | BTC Purchased |

| 1st Aug, 2024 | 169 |

| 20th June, 2024 | 11,931 |

| 1st April, 2024 | 164 |

| 19th March, 2024 | 9,245 |

| 11th March, 2024 | 12,000 |

| 26th Feb, 2024 | 3,000 |

| 6th Feb, 2024 | 850 |

| 27th Dec, 2023 | 14,620 |

| 30th Nov, 2023 | 16,130 |

| 1st Nov, 2023 | 155 |

| 24th Sep, 2023 | 5,445 |

| 1st July – 27th July, 2023 | 467 |

| 29th April – 27th June, 2023 | 12,333 |

| 5th April, 2023 | 1,045 |

| 27th March, 2023 | 6,455 |

| 24th Dec, 2022 | 810 |

| 22nd Dec, 2022 | -704 |

| 1st Nov – 21st Dec, 2022 | 2,395 |

| 20th Sep, 2022 | 301 |

| 28th June, 2022 | 480 |

| 15th Feb – 5th April, 2022 | 4,167 |

| 1sth Jan – 31st Jan, 2022 | 660 |

| 30th Dec, 2021 | 1,914 |

| 29th Nov – 8th Dex, 2021 | 1,434 |

| 28th Nov, 2021 | 7,002 |

| 13th Sep, 2021 | 8,957 |

| 21st June, 2021 | 13,005 |

| 18th May, 2021 | 229 |

| 13th May, 2021 | 271 |

| 5th April, 2021 | 253 |

| 12th March, 2021 | 262 |

| 5th March, 2021 | 205 |

| 1sth March, 2021 | 328 |

| 24th Feb, 2021 | 19,452 |

| 2nd Feb, 2021 | 295 |

| 22nd Jan, 2021 | 314 |

| 21st Dec, 2020 | 29,646 |

| 4th Dec, 2020 | 2,574 |

| 14th Sep, 2020 | 16,796 |

| 11th Aug, 2020 | 21,454 |

It was on 11th August 2020 that MicroStrategy made its first Bitcoin purchase. On that day, it made a heavy purchase of 21,454. In that year itself, it made at least two more heavy purchases: the 16,796BTC purchase on 14th Sep and the 29,646BTC purchase on 21st Dec, 2020. What it indicated was that from the beginning stage itself, the public company had a strategy to consistently boost its BTC holdings.

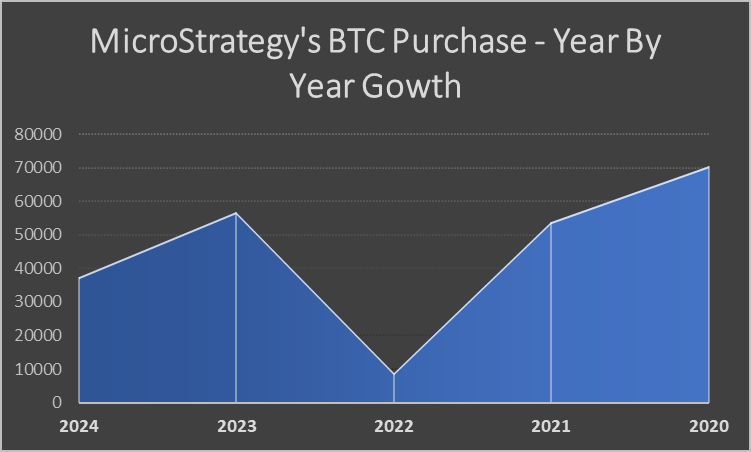

| Year | BTC Purchased |

| 2024 | 37359BTC |

| 2023 | 56650BTC |

| 2022 | 8813BTC |

| 2021 | 53921BTC |

| 2020 | 70470BTC |

This year, 2024, so far, the company has purchased around 37,359 BTC. The highest purchase was made on 11th March. Days before, the BTC price touched an all-time peak of $73,000. Another purchase of similar intensity was made a couple of days after the peak day. On 19th March, nearly 9,245 BTC was purchased. Recently, on 20th June, around 11,931 BTC were purchased.

It was in the year 2020 that the most number of BTC purchases occurred. In that year, over 70,470 BTC purchases took place. The year 2022 was not a good year in terms of MicoStrategy’s BTC Purchases. In that year, the company made no purchase of more than 8,813 BTC. It was the only time a negative purchase happened. On 22nd December 2022, a negative purchase of -704 was reported.

The year of 2021 and 2023 were identical. In both these years, not less than 50,000 BTC were purchased. Interestingly, the nature of purchase in each year was different. In 2021, it was a mix of small and large purchases. The smallest of those purchases was the purchase of 205 BTC, reported on 5th March 2021, and the largest was the purchase of 19,452 BTC, reported on 24th Feb, 2021. In 2023, at least three big purchases were reported: the 14,620 BTC purchase on 27th Dec, the 16,130 BTC purchase on 30th Nov, and the 12,333 BTC purchase between 29th April and 27th June.

Top Private Companies by Bitcoin Holdings

Before going to the conclusion part, we can go through the nature of the BTC holdings of the private companies category and understand how it is different from the public companies category.

| Companies | Bitcoin Holding | Bitcoin Holding (%) |

| Mt. Gox | 200,000BTC | 0.952% |

| Block.one | 140,000BTC | 0.667% |

| Tether Holdings LTD | 75,354BTC | 0.359% |

| Xapo Bank | 38,931BTC | 0.185% |

| BitMEX | 36,794BTC | 0.175% |

| The Tezos Foundation | 17,500BTC | 0.083% |

| Stone Ridge Holdings Group | 10,000BTC | 0.048% |

| Massachusetts Mutual | 3,500BTC | 0.017% |

| Lisk Foundation | 1,898BTC | 0.009% |

| Seetee AS | 1,170BTC | 0.006% |

Here, we can clearly see that unlike the public companies category, there is no domination of the top player. The difference between the number of Bitcoins held by the topmost in the list of the top private companies Bitcoin Holding and the second topmost is just 60,000 BTC. Mt.Gox, the topmost company in the list, holds around 200,000 BTC, and Block.one , the runner-up in the list, has 140,000 BTC. Tether Holdings LTD, Xapo Bank and BitMEX are the other important companies on the list. Tether Holdings LTD has around 75,354 BTC, and Xapo Bank and BitMEX have 38,931 BTC and 36,794 BTC, respectively.

Endnote

MicroStrategy’s aggressive Bitcoin acquisition strategy has positioned it as a key player in the public companies category. Despite a slight slowdown in 2022, the company regained momentum in 2023, with several high-volume purchases. As we move further into 2024, it’s worth watching whether MicroStrategy will surpass its 2020 record for Bitcoin acquisitions and what impact this will have on the broader market.

Also Read: Case Studies of Countries with Significant Crypto Adoption

Source: https://coinpedia.org/research-report/microstrategys-bitcoin-holdings-unraveling-a-high-stakes-investment-strategy/

Dieser Beitrag ist ein öffentlicher RSS Feed. Sie finden den Original Post unter folgender Quelle (Website) .

Unser Portal ist ein RSS-Nachrichtendienst und distanziert sich vor Falschmeldungen oder Irreführung. Unser Nachrichtenportal soll lediglich zum Informationsaustausch genutzt werden. Die auf dieser Website bereitgestellten Informationen stellen keine Finanzberatung dar und sind nicht als solche gedacht. Die Informationen sind allgemeiner Natur und dienen nur zu Informationszwecken. Wenn Sie Finanzberatung für Ihre individuelle Situation benötigen, sollten Sie den Rat von einem qualifizierten Finanzberater einholen. Kryptohandel hat ein großes Handelsrisiko was zum Totalverlust führen kann.